3/5/2008 Wed

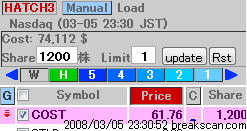

COST: Double Profits

Gapper's

Eye utilizes our original unique stock scanner, Break Scan, and sophisticated

chart software, CQG. With nominal fee, the Break Scan is available to our

members.

The Kamikaze Gap Play

was introduced to the U.S. traders in the

August 2005 issue of Active Trader Magazine.

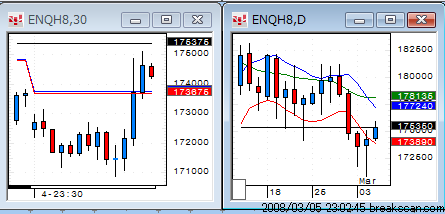

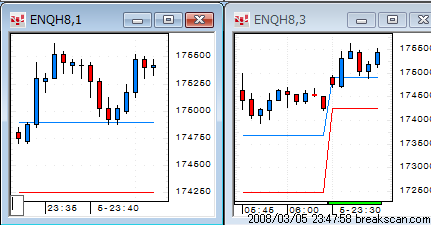

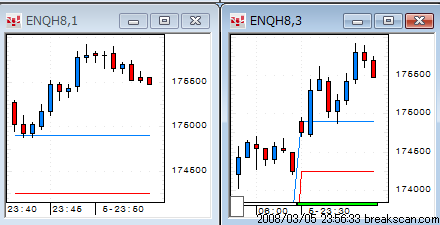

The Nasdaq gapped up on the

open.

The green dot indicates the opening

price.

Excerpts from Net Aid:

2008-03-05 23:02:15 hatch

The Nasdaq formed a long tail yesterday.

2008-03-05 23:03:20 hatch

The futures are strong.

2008-03-05 23:05:50 hatch

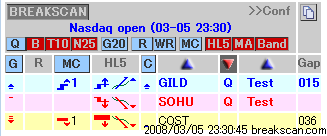

Long candidates are:

2008-03-05 23:05:56 hatch

GILD

2008-03-05 23:06:07 hatch

STLD

2008-03-05 23:06:16 hatch

TEVA

2008-03-05 23:08:36 hatch

BUCY

2008-03-05 23:08:43 hatch

CELG

2008-03-05 23:09:07 hatch

GENZ

2008-03-05 23:09:18 hatch

ILMN

2008-03-05 23:09:31 hatch

MCHP

2008-03-05 23:20:00 hatch shadow

Short candidates are: UAUA, COST,

JOYG and SOHU.

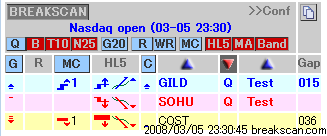

2008-03-05 23:30:09 hatch shadow

The market has opened.

2008-03-05 23:30:19 hatch shadow

Long CELG.

Up $120 for 500 shares.

2008-03-05 23:30:37 hatch shadow

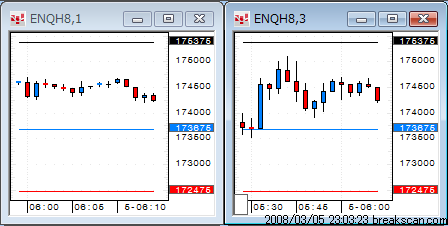

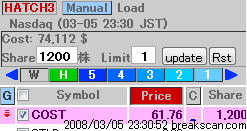

COST is shown on hatch 3.

2008-03-05 23:30:46 hatch shadow

Long BUCY.

Up $308 for 200 shares.

2008-03-05 23:30:56 hatch shadow

GILD.

Up $140 for 500 shares.

2008-03-05 23:34:26 hatch shadow

Short COST here.

A 30-min. gap pattern

2008-03-05 23:35:38 hatch shadow

STLD

Up $755 for 500 shares.

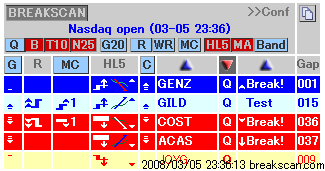

2008-03-05 23:36:33 hatch shadow

COST and ACAS are short prospects.

2008-03-05 23:45:14 hatch shadow

AKAM

Up $1238 for 1200 shares

- hatch shadow

- COST moves about 1.7 point a

day.

Up $1236 for 1200 shares

Up $250 for 1000 shares.

Up $275 for 500 shares.

-

-

Short near the open price.

-

Up $1008 for 1200 shares.

The index finished with an up

bar.

Gapper's Eye Index

Daytradenet Top

Charts courtesy of CQG

Source: 2006 CQG, Inc. All rights reserved worldwide.

Red

and blue zones show the gap of the preceding day.

The Green zone indicates the profitable zone of trading.